In Brief

Measuring production in money leads to the production of more money and less wellbeing across a country. Money is a moving measuring stick. An objective, science-based account of economic activity reveals major problems hidden in claims of GDP measured in dollars. Wealth and income are measured in money, but output, as contribution to a community, and subsequent worthiness and wellbeing, demand a more objective assessment. Managing financial systems inevitably leads to gaps between who does work and who benefits. Work is a real concept in economics and science. Dissatisfied with accounting in money terms, one avenue pursued to assess levels of economic activity is energy analysis. This paper takes steps back in science to address the physics of force and work and identifies the electromagnetic force stored in the chemical bonds of oxygen, triggered as available to do work by carbon bonding, as a useful universal metric for economic activity, serving as a backdrop to check GDP growth.

Calculating work done applies at any scale in any situation, from an individual climbing stairs to global GDP, all based on oxygen bonds gulped and broken. Viewing capital as a history of embodied work done, a graph of purposive oxygen bonds broken on Earth 1750-2017 covers at a glance the sum of human endeavors. All human activity fits within that framework and zooming in on economic analysis at any scale forces acknowledgement of boundary constraints. Increased entropy has nowhere to hide.

Key Concepts

- Dollar values assigned to economic activity, through ignorance or design, can be misleading. There is an objective, scientific currency that can serve as a check on money-based reports on how much a nation has produced.

- Managing complex flows of matter is an economic activity that can be reduced conceptually to the purposive release of just one form of energy.

- The charge extant between electron-proton pairs in oxygen and carbon atoms maneuvers into tighter arrangements during combustion and the bond count serves as an objective universal metric for human activity at any scale.

- Regardless of food, fodder or fossil fuel, it is the oxygen bond count in combustion that counts.

- The force released amounts to work, and today’s work done is tomorrow’s capital.

- The annual change in count of oxygen bonds broken serves as a useful backdrop for trying to explain and correct estimates of annual GDP growth.

Measuring the economy

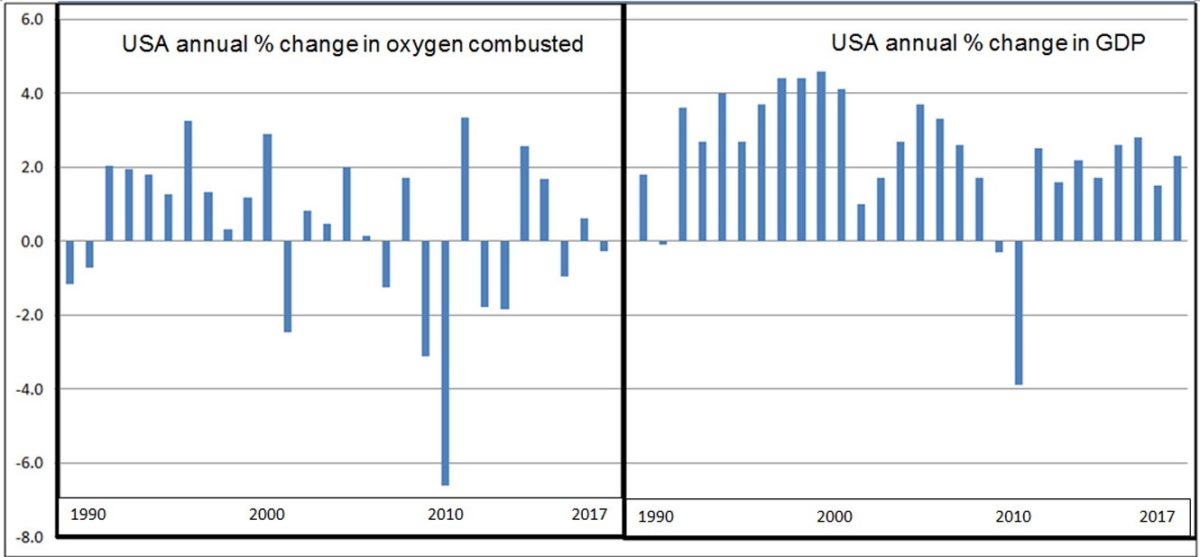

In managing how the world should work, an influential article in Nature led with the statement that “Gross Domestic Product is a misleading measure of national success” and urged countries to “embrace new metrics”.i As reported in this journal, there has indeed be a move by many countries and provinces to seek more realistic data on sustainability.ii A solution to identify key factors serving wellbeing is in the combining of science and economics to measure all activities by the changes in chemical bonds made. From the simple act of breathing, up through the refining of metals, to complex manufacturing and what a whole country produces, the aggregate of oxygen-oxygen bonds exchanged for an oxygen-carbon bond is an insightful indicator of work done. As shown in the graphs leading this article, the poor performance in production in the US 2001-2010 can be identified objectively in science but was hidden in dollar-based National Accounts until after the crises of 2008.

The wealth of nations has been mused since the reign of Solomon. Chests of gold and silos of grain were the early measures, and the advent of national accounting in the USA 80 years ago soon led to a movement within each country having buildings of staff working on their GDP. Leaders across the spectrum of polities hope to placate constituents with news of GDP growth even if not reflected in infrastructure and social fabric. GDP data shines even with and especially if reckless growth results in more pollution cleanups and increased health costs. Money management becomes unhinged from the real goods and services that money is supposed to represent, and “making money” sinks into to “making-up money”.

Backlash in the form of a search for a new economic paradigmiii has led to attempts at Green GDP and the Genuine Progress Indicator. China published Green GDP data in 2006, embarrassing provincial leaders to the extent that it was not published in subsequent years, even though an army of public servants collect data and present a Green GDP Report which is not released.iv The Genuine Progress Indicator (GPI) can show what many people feel – that they are no better off in general wellbeing than twenty years ago, even though GDP would suggest otherwise. The GPI is now an official instrument for policy planning and management in some regional governments, and is proving a useful tool.v However the basis for the index relies on surveys, interviews, and people’s perceptions, and not on the hard facts of financial records.

To tie financial accounting down to what is really happening, attempts are made to link to science. The First Law of Thermodynamics can be comprehended as the conservation of matter and energy. In practice a good representative of finite matter is gold. Various attempts at linking a nation’s money to gold have been tried, most responsibly by Great Britain and then the USA, but no country has been willing to try in the last 50 years. Energy is a more malleable concept, yet said to be conserved (indestructible) and therefore applied as a measurement of economic activity. During the energy crises of the 1970’s it was popular to look on manifestations of energy as a currency.

In the past half century there have been earnest studies to link economic activity to energy in some way. Odum’s “emergy”,vi Szargut’s exergy vii and Georgescu-Roegen’s entropy analysis viii all have intuitively potential insights into the science of economic production and consumption processes. This paper critically reviews the concept of energy and its relevance to the physics, chemistry and engineering that are the basis of primary and secondary industries.

“We have no knowledge of what energy is”

Richard Feynman exclaimed that we do not know what energy is, adding, “we do not have a picture that energy comes in little blobs”.ix And if the purer sciences need care with the concept, even more so in accounting for economic activity. Coal mining in England around 1750 provides an enlightening case study in energy economics before the term “energy” had been introduced. Coal mining is the provision of a resource formed by nature but requiring socio-economic inputs to extract and deliver. The phenomenon of “energy” resides both in the coal and in the work done on it. In Ricardo’s economics, in situ coal is “virgin land” and (especially if you do not know it is there) has no cost. A major cost in coal mining operations, however, is the vertical lift to the surface, not only of coal, but disposing of water threatening to flood the mine. Before the term, “energy”, was coined by Thomas Brown in 1804, James Watt had already popularized the notion of “horsepower” which he defined as 180 pounds lifted 181 feet in 1 minute (rounded to 33,000 foot pounds).

The idea of lifting 1 pound weight 1 foot high is elegant and practical, set in the equation “work equals force times distance”, W =F x d, only enunciated in physics in 1829 by Coriolis. It should go without saying that force is the vertical force needed to overcome gravitational force. The “energy” term entered wider discussion with Joule’s experiments reported 1845 linking mechanical work to heat. The idea of convertibility, and of the conservation of energy (in some form) evolved into the field of Thermodynamics and the First and Second Laws, impacting on chemistry, electricity and public imagination.

Joule’s presentation of his results as “The Mechanical Equivalent of Heat” was an exciting advance, discrediting caloric theory, but also lent itself to future confusion. In hindsight a more precise naming on his discovery could have been, “The link between work done by gravitational force and the maximum heat that can be derived from that work”. That title is not as catching, but does not pretend any energy forms are “equivalent”. The force of gravity can be harnessed to churn water and raise its temperature, but warm water will not lift weights back up with the same efficiency.

Gravitational force is special. It is directional and constant, and though we have no idea of what it really is, for all practical purposes in everyday life, its source is the massiveness of planet Earth. Other forces – a push or pull, the force of wind, come from diverse sources of energy, and can manifest themselves in various forms. There is no universally agreed list of forms of energy, though most texts list about six groups which may overlap depending on user perspective. Discounting the force of gravity because it is free and the strong force inside nuclei, the only one force left to drive action (including economic activity) is the electromagnetic force (emf).x

If we return to Watt’s comparing of steam engines against horse power, a joule is lifting 102 grams one meter against the force of gravity. But the link to gravity was dropped in the 1946 world conference on measurements because, quite reasonably for scientific exactness, gravitational force varies by 0.7% between the extremes over the surface of the Earth. The replacement definition requires us to imagine a mass of 1 kilogram with no gravitational forces acting on it experiencing some force that will accelerate it at 1 meter per second. That is hard to imagine, in high school physics, and in professional economic research. The upshot is confusion in energy analysis of economic activities.

The energy concept gets only general treatment in economics, as if the details are taken care of in science. Reference to the relationships water has with food, energy and environmentxi has firmed into discussion of a “water-energy-food nexus”.xii The natural water cycle is now almost always augmented with construction of storage facilities and channeling and with pumping. That is, humans must intervene with energy investments, that can just be a dollar value, with the details left to engineers. Simply put, energy “inputs” are monetized and commodified.xiii

Yet big-picture accounting of physical economic activities provides a useful backdrop to dollar cost benefit analysis. It can identify misunderstandings in double counting, counting line items that don’t belong and failure to count “externalities” which do count in the big picture. Energy is not just another commodity, another input to an ecosystem and is not some single digit percentage of a country’s GDP. In science there is only matter and energy, and economics never counts “matter” as a generic input.

Economics needs to reverse engineer some ecological science and reassemble it in a new approach more useful to economic analysis. Energy in economics is more mysterious than rocket science. The scientists have left key problems unsolved. As a case in point, gasoline prices figure prominently in economic scenarios, and yet how science relates gasoline combustion to the environment seems unimportant in engineering and a mystery in economics.

Fueling the economy – chemistry’s hidden debt

In chemistry, the reactants in gasoline combustion are accounted as having bond strengths totaling 16 kj/mol and the products as 21 kj/mol. The change in enthalpy is -5 kj/mol and it is this negative number that consumers demand and countries go to war over. Chemical engineers ignore the minus sign and convert this to Mj/liter, and then for a family car, 16 miles/gallon or 7 liters/100 km. The chemistry gives us the magnitude of the number accurately but hides what needs to be recognized for modelling in ecological economics. It does not make economic sense. If the energy units were dollars it would seem that the gasoline costs $16 and emissions $21 and as well allows $5 worth of energy is released, available for human use. From an economic sense it would be expected to start with a certain investment and portion be directed for beneficial use and, due to imperfect efficiency, the remainder emitted as waste. In chemistry the numbers seem the wrong way around. It just does not add up.

Over the past hundred years chemistry has established tests for the energy cost of separating the bonds that hold atoms in molecules. It is impossible to manually separate an individual bond between two atoms but practicable to do it between large batches (6 x 1023 molecules). The published results serve the purpose of showing that when a fuel combusts with oxygen, the difference in bond energies in resultant molecules is the amount of energy released and “available” for economic use (heating, driving a car, etc.). Table 1 summarizes this lab test.

Table 1. The combustion of gasoline shows that the total bond energy of the product molecules is greater than that of the reactants, and the difference (taken as a positive quantity) is the amount of energy released and “available” for economic use.

An attempt is made here to venture between chemistry and economics to provide an explanation of the system at work. An atom is a structure unlike anything in macroscopic engineering, but obeying strict quantum mechanics laws. The rearrangement of valence electrons seeking tighter bonds in neighboring atoms occurs against a backdrop of the total energy in each atom. Chemistry text books refer to the “internal energy” by the symbol “U” and deem it unknowable. Given the complexity of the Schrodinger equation and acknowledging we cannot pin down electrons’ positions, it seems clear that there is no exact answer. This should not bother economists, and guessing internal total emf as the sum of bond strengths of valence electrons comes up with an estimate that can be improved on later. See Pull-out Box 1 Where does bond strength come from? for this approach to understanding the relevance of bonding in the context of “total energy” in a single diatomic oxygen molecule.

Figure 1 displays the conventional approach and a new approach that recognizes what happens when energy is tapped from the overall ecosystem. The conventional approach has been used for many decades because it gives the correct magnitude of energy released from a mole of gasoline (except it has a minus sign). The alternative approach provides a new and humbling understanding of the bigger picture. The energy made available is about 2% of the internal energy of the reactants, and once done the products are locked in tighter bonds where there is no more energy available.

Figure1. Calculating the energy released from 1 mole of gasoline in conventional chemistry and using an approach acknowledging where the energy is made available from.

This pattern is demonstrated using the chemistry lab situation of a mole of gasoline (octane, C8H18). But the pattern is the same when graphing just one molecule of octane, or a liter, ton or million barrels. Furthermore other hydrocarbons – methane, propane, exhibit the same pattern with the energy released being 2.1% of the internal energy (as calculated in the Supplementary Material). The energy released from coal is less because of impurities with the representative bituminous coal compound in the Supplementary Material calculated as 1%. The value for carbohydrates is 1.6%. In general, for pure hydrocarbons the energy released is 1.5% of the internal energy (as estimated) of the oxygen combusted.

Carbon exchange with oxygen as objective measure of economic activity

This approach, at any scale, serves as a model for the realistic appreciation of purposive release of energy in any economic activity. It answers Feynman’s cry for what that energy “is”. It is indeed the “little blobs” he sought, in the form of electron-proton pairs within atoms, that can rearrange combinations of atoms to save about 2% of their required internal structural maintenance forces.

The right hand half of figure 1 is replicated in figure 2 with the bond exchanges shown occurring as the reactants become products. In figure 2 and its right hand half, the purposive act of extracting energy from the reactants can be shown in the exchange of bonds that results in the slightly tighter arrangement of products with the difference being what we perceive as the energy released. Only 2% of the energy internal to the reactants is made available for economic use. This is a humbling surprise for economic actors and for analysts of economic behavior. An explanation of the reaction in the center of figure 2 is set out in Pull-out box 2.

Figure 2. In the simplest hydrocarbon, the mol of methane is said to “produce” or “release” about 8 megajoules of energy made available for economic use. In this figure it is shown that what we call energy is about 2% of the internal energy of the atoms in the reactants, and is the result of a small saving in structural maintenance of the new compounds because of their slightly tighter bonds.

Work as lifting against gravity

Rather than Joule’s comparison of weights falling with water temperature rising (and referring to their “equivalence”) the notion of lifting is a useful way of presenting economic activity. It is like lifting the stone blocks to make a huge pyramid, and the test can applied to how much you lifted today, in a year, or lifetime, and the same for companies, countries and the globe. The sobering realization is that all of human endeavor is an aggregate of this. Financial calculations need to match the physical reality.

In the stark example of a forklift rated at 44 kw lifting a 4.488 ton item 1 meter high in 1 second, this is the result of 15 x 1021 molecules of C3H8 combusting with 75 x 1021 molecules of O2. In that 1 second each of 45 x 1021 carbon atoms trades up from its bond with hydrogen and locks in between two oxygen atoms. The swap results in a saving of about 6 electron volts (ev) in the required internal structural maintenance in each of the product molecules. That 6 ev, times 45 x 1021, is the energy released in all directions at the level of atoms that can be directed and harnessed in an engine cylinder to lift 4.488 tons 1 m high against the force of gravity (theoretically 44,000 joules or 2.7 x 1023 ev.). This calculation is for full throttle (1 gram propane per second) and empirical tests would present a lesser result.

Forklifts also transport items horizontally but if the combustion rate was the same as when lifting then the work done horizontally including against friction could be deemed equivalent to a weight lift. All and any work done, based on calculation of oxygen molecule bonds broken and exchanged for oxygen-carbon bonds can be represented as an equivalent “lift against gravity”. A weightlifter may lift 50 kg 2 meters, and unlike the forklift, there is not direct instantaneous register of bond exchanges, but there is no doubt it does happen and there is an objective link between daily intake of carbon atoms (in carbohydrates and proteins) and work done, not only in lifting but all forms of work. It is observed that heat results from work done at the scale of atoms.

The solution this approach delivers is that it gives a closer picture of contributions to economic activity than GDP or income dollars. Speculation is a zero sum game and has zero net production. Stimulus packages do add to production, stirring economic activity where there was none. Millions of economic actors can sense that their oxygen intake, direct and indirect, results in work done. The more that that fact is considered, with its implications and the chain of indirect processes that combust, the clearer it becomes. Even in tertiary industries with seemingly sedentary work, there are distant but vital links to physical activity that can be related to lifting work. This serves as an antidote, if not a solution to investment whisperers who portray that they can “make money” by paying high returns drawn from the investments latter hopefuls have made. Mere manipulation of money in such practices performed by Madoff and such operators detailed in the documentary film “Inside Job” could not occur if required to show what work was done.

An all-perceiving alien sweeping by our planet 20,000 years ago would see the natural Earth with imperceptible human economic activity. Today a similar sweep would see pyramids and skyscraper cities, traffic clovers and large swathes of land radically transformed for better or worse by farming, deforestation, polluting, and in the past decade, proliferation of solar panels. A glance at the globe could be encapsuled in the sum of diatomic oxygen molecules broken since the start of the Industrial Revolution, 1750, up to 2017. The various engines and facilities that capture the flows of released energy were manufactured and their history from extraction, processing, assembly and transport is the history of past bond trades. Figure 3 graphs the estimated number of oxygen-oxygen bonds broken by human volition 1750 up to 2017 and projected onward to 2040. The period starts with most work done by heavy panting – labor fueled by food and fodder, supplemented by fires fueled by wood and lamps flickering on oil from animal fat. Coal supplanted firewood as main fuel mid nineteenth century.

Progress made through capital formation can be modeled by application of an inverse version of figure 2 to the timeline of figure 3. The process depicted in figure 2 represents an engine of growth inhaling oxygen-oxygen on the right and the bonds broken by trading for an oxygen-carbon bond to reduce the need for internal structural maintenance of the atoms involved. The emf released is directed out the left side to “do” something such as heating or moving. Humans have evolved complex organizations and systems that produce goods and services that can then be built on for further gains in perceived wellbeing. It is like a rolling railway operation that lays line and peripheral infrastructure as it progresses. In figure 3 the chemical reaction depicted in figure 2 represents all the technical processes that trade an oxygen atom for a carbon bond “profiting” 3.2 ev. It can be conceptualized as a juggernaut climbing the slope of human progress, being able to rise higher through the benefits of high-order, low-entropy capital that has been laid out up to that point. The red arrow is not quantified in this paper but suggests an avenue of insights for further research. It represents high entropy inexorably produced from the reaction and can lead to the choking of further progress.

Figure 3. From the start of the industrial revolution through to expected purposive release of energy in 2040 global annual aggregate has risen from 4 to 874 exajoules. The annual number of oxygen-oxygen molecules broken can be tracked and is projected to be 1,343 x1036 in 2040.

The almost flat line along the X axis is a record before the “sharp rise in energy” shown in such graphs as presented in by the International Energy Agency (IEA)xiv and the World Bankxv. The IEA uses as units, millions of tons of oil equivalent (Mtoe) and the World Bank, terawatt hours (Twh) to unify various forms of energy. In so doing the concept of energy becomes even more abstract than dollars. Money feels real, even though it is an abstraction, yet what it is supposed to represent is subject to misunderstanding and manipulation. Oxygen molecules are real and we die without them in minutes. The oxygen-oxygen bond is real and fixed. Oxygen is an invisible gas, but the bond between atoms is strong and real like the bonds between atoms in a bar of iron. The bonds and the matrix of charges in electron-proton pairs that makes them are Feynman’s “little blobs”. Unlike money they cannot be magically conjured up. Though tricky at the level of macroeconomics or enterprise cost-benefit analysis they are an aggregate of the number of breaths made by workers and the oxygen flow drawn in by engines and furnaces. The more complex the process the greater the distance and time in the cost chains. But unlike economics in money terms, micro-economic activity adds up to macro-economics. The model is an advance on the currently promoted textbook “circular flow of the economy” that draws inspiration from farming in France around 1750. The model does not address nuclear energy drawn from the entirely different strong force inside nuclei.

A caveat needs to be assigned to the key word, “growth”. This paper makes no comment on what the aggregate of goods and services in a nation should be. Apart from producing “goods” there are also “bads” produced, but they are driven by the same technologies as goods and therefore show up on figure 3. The critique of this paper is that leaders become possessed of growth mania and encourage professionals in economics and finance to come up with dollar values that are supposed to reflect good leadership, even if there are no material benefits. The US Treasury $700 billion stimulus concocted on 19 September 2008 required no material reality. It cannot show up on a figure 3 graph. In the two bar charts at the top of this article the problem is hidden in dollar accounts until 2010, but in physical economic activity (and lack of it) the signs begin in 2001.

Summing up

This approach delivers a model of economic activity on a scale in time and magnitude from Adam Smith’s example of hunters trading deer and beaver up to the existing global economy. The knowledge that grand activities consist of real atoms and their real bonds means that cursory material flow analysis can highlight errors that supposed “due diligence” by financial accountants may miss. Anomalies draw focus and any entropy error, by ignorance or design, will unfold. Investors who care about their money will want this approach applied to any project targeted.

The current reliance on conventional economic models as a basis for financial analysis may lead to an assumption that any big amount of money is an aggregate of the small amounts most people are familiar with in daily activities. But devious manipulation of the money numbers in large activities is endemic. A stimulus package is a game with key players arguing wild, huge numbers. In high-profile sales, the prices can be outlandishly contrived through collusion to alter market dynamics. A quick assessment of the “weight of work” in any activity and transaction is a wholesome reality check. Ultimately, any goods or service item can be traced back to the work done and its equivalent weight lifted (this makes more sense than calories of heating, and much closer to reality than linking big dollars to the price of apples or a week’s wages). In any item the trail of oxygen bonds must add up. It relates to work done. Machines or people worked for it.

In short:

- This approach jolts analysts of economic activity to acknowledge cost require work and work can be traced to aspirated engines, biological and mechanical.

- Production, including GDP, requires economic action, and the cost of that activity has a scientific basis.

- GDP measured as trading chemical bonds cannot be conjured up.

- The raw and earthy truth is hard work requires heavy breathing and in modern major projects that work is embodied in resources, capital equipment and infrastructure as well as direct human labor.

- In the two bar charts at the start of this paper, had analysts used the first chart, they would see sluggish activity beginning 2001 would lead to a financial crisis.

It is the aspiration of this paper that scientists and economists can work together to refine an objective numerical scoring system to assess the costs of human activity. One direction to be developed, to be understood and accepted by analysts of economy and society is to estimate (as referenced in an article in the journal of the China Ministry of Ecology and Environment, opening depicted Figure 4) for an individual the general observed benefits contributed (numerator) and also the draw-down on the environment imposed by such activities (denominator).

Figure 4. Opening of a 2013 article in the journal of the China Ministry of Ecology and Environment comparing a simple laborer with the (then) real estate developer, Donald Trump, with “scores” in gigajoules for contributions and damage to their surroundings.

[1] Costanza, R. et al. Time to leave GDP behind. Nature. 505 (3). 2014.

[2] Costanza, R. et al. Toward a sustainable wellbeing economy. Solutions. Volume 9 Issue 2 April 2018

[3] Button, D. Stop obsessing about GDP: we should focus on wellbeing, The Guardian. 10 June 2019

[4] Kahn, J & Yardley, J. As China roars, pollution reaches deadly extremes. New York Times, 26 August, 2007.

[5] Kubiszewski, I. et al. Beyond GDP: Measuring and achieving global genuine progress. Ecological Economics. Vol 93. September 2013.

[6] Odum, HT. Environment, Power and Society. Columbia University Press. New York. 2007

[7] Szargut, J. Exergy Method. WIT Press. Southhampton. 2005

[8] Georgescu-Roegen, N. The Entropy Law and the Economic Process. Harvard University Press. Cambridge, MA. 1971.

[9] Feynman, R. Feynmanlectures.caltech.edu/I_04.html

[10] Coulter, J. The chemistry of markets. Ecological Economics. Volume 41. January 2002

[11] Hellegers, P. et al. interactions between water, energy, food and environment: evolving perspectives and policy issues. Water Policy 10 Supplement 1. 2008.

[12] Bennett, G. et al. Natural infrastructure investment and implications for the nexus: A global overview. Ecosystem Services 17, 2016.

[13] Gómez-Baggethun, E. et al. The history of ecosystem services in economic theory and practice: From early notions to markets and payment schemes. Ecological Economics. Volume 69, Issue 6. 1 April 2010.

[14] https://www.iea.org/publications/freepublications/publication/KeyWorld2017.pdf

[15] https://ourworldindata.org/energy-production-and-changing-energy-sources

[16] Coulter, J. Ecological civilization is a numerical score. World Environment Volume 3. 2013.